TGIF 27 June 2025 — Pooling orders possible in group liquidation, but under what provision?

27 June 2025

This week’s TGIF examines the recent decision of the Federal Court in Reid, in the matter of Kununurra Panel Beating Works (Holdings) Pty Ltd Ltd (in liq) [2025] FCA 593 (Kununurra). In providing a helpful summary of the principles applicable to applications for pooling orders, the Court has also indicated that the traditionally broad scope of section 90-15 of the Insolvency Practice Schedule (Corporations) (IPSC) is not without its limitations.

Key takeaways

- Pooling orders are a handy tool available to liquidators appointed to multiple companies, allowing them to circumvent unnecessary and costly investigation into intercompany affairs and maximise payment to creditors of the companies as a whole.

- A court must refuse to make a pooling order if it would materially disadvantage an unsecured creditor, taking into account the size of the creditor’s business and the relative quantum of its claim.

- Liquidators must ensure that their application for pooling orders satisfies the criteria of section 579E of the Corporations Act 2001 (Cth) (Act). A court will be very reluctant to allow liquidators to use the catchall provision in section 90-15 of the IPSC where a specific power to make pooling orders exists.

Background

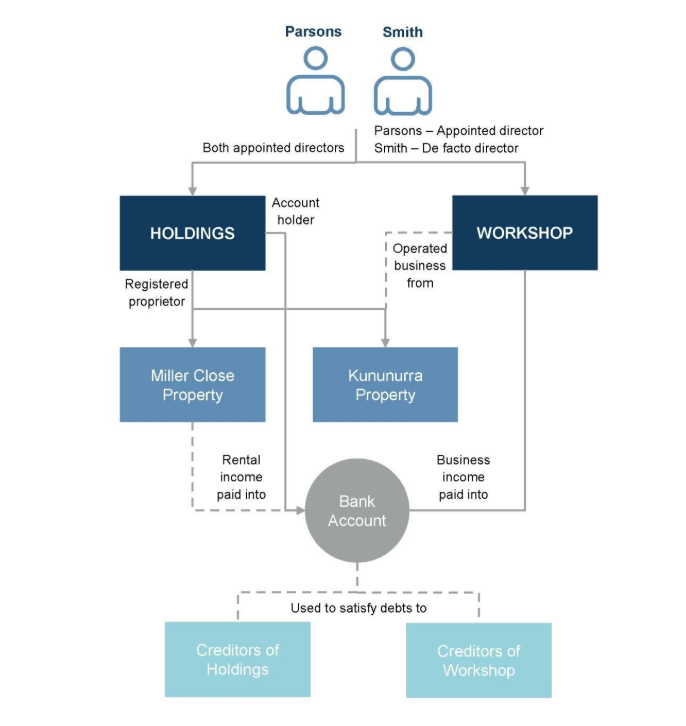

Kununurra Panel Beating Works Pty Ltd (in liq) (Kununurra Workshop) carried on a panel beating business, operating from two premises in Kununurra (the Kununurra Properties), which were owned by Kununurra Panel Beating Works (Holdings) Pty Ltd (in liq) (Kununurra Holdings). Kununurra Holdings was also a sublessor of a property in Nhulunbuy, Northern Territory (Miller Close Property). Both Kununurra Workshop and Kununurra Holdings (together, the Companies) had common directing minds; Mr Parsons and Mr Smith.

Relevantly, Kununurra Workshop did not have any identifiable bank accounts. All income obtained through Kununurra Workshop’s business was deposited into an account in the name of Kununurra Holdings (Bank Account).

Kununurra Holdings’ rental income was also deposited into the same Bank Account. Kununurra Holdings’ Bank Account was used to meet the expenses and liabilities of both Companies.

A visual depiction of the interrelationship between the Companies is set out below:

At the date of appointment of Reid (the Liquidator), the Companies had the following creditors:

| Company | Creditor | Amount |

|---|---|---|

Kununurra Workshop | ATO | $1,496,318.95 |

| ASIC | $652.00 | |

| Cleanaway Waste Management Pty Ltd | $1,280.18 | |

| Horizon Power Pty Ltd | $7,382.74 | |

| Total | $1,505,633.87 | |

Kununurra Holdings | ATO | $715,638.14 |

| Telstra Corporation Ltd | $1,218.21 | |

| Total | $716,856.35 |

The effect of the relationship between the Companies was that there were significant assets available in Kununurra Holdings to satisfy its creditors, but insufficient assets in Kununurra Workshop to satisfy creditors.

To overcome this difficulty, the Liquidator applied to the Court seeking orders pooling the assets and liabilities of both Companies.

Section 90-15 of the IPSC and pooling orders

The Liquidator did not originally apply for a pooling order under section 579E of the Act. Rather, his application sought to invoke the broad power of the Court to make orders in relation to the external administration of a company, pursuant to section 90-15 of the IPSC. This was because, at the time of making the application, the Liquidator was not certain that the Companies could satisfy any of the “gateway criteria” in section 579E(1)(b) of the Act.

As at the time of the hearing, however, the Liquidator sought leave to amend his application to instead seek orders under section 579E of the Act. Although leave was granted, O’Bryan J nevertheless opined on whether such orders could be made under section 90-15 of the IPSC.

His Honour expressed real doubt as to whether pooling orders could be made under section 90-15 of the IPSC. Despite the breadth of section 90-15 of the IPSC, the Liquidator had been unable to identify any cases in which section 90-15 had been utilised to make the pooling orders sought.

The powers to make pooling orders is specifically provided for in section 579E of the Act. O’Bryan J was guided by the principle of statutory construction that, “When a statute confers both a general power, not subject to limitations and qualifications, and a specific power, subject to limitations and qualifications, ordinarily the general power is construed as not authorising that which is the subject of the specific power.”

Application of section 579E of the Act

O’Bryan J was satisfied that the requirements of section 579E of the Act were met. Accordingly, his Honour made orders pooling the assets and liabilities of Kununurra Holdings and Kununurra Workshop.

As to whether the Companies together formed a ‘group’, the Court noted that the term simply required a “collection or plurality” and did not require any shared characteristics between them. It was sufficient that the Liquidator had simply identified two or more companies which existed at the time the orders were sought.

Section 579E(1)(a) of the Act was satisfied, simply because the Companies were both in liquidation. As to section 579E(1)(b) of the Act, his Honour was satisfied that subsection (iv) was applicable, because rent received by Kununurra Holdings from the Miller Close property was used to pay various expenses incurred by Kununurra Workshop in carrying on its panel beating business.

The Court recognised that Telstra, as an unsecured creditor of Kununurra Holdings, would be adversely impacted, because it would receive a reduced dividend under a pooling order. Nevertheless, the Court did not consider the adverse impact to Telstra to be ‘material’ (so as to enliven section 579E(10) of the Act), because:

- given Telstra was only a creditor in the amount of $1,218.21, the pooling order would ultimately result in Telstra “being only a couple of hundred dollars worse off”; and

- the size of Telstra’s business made such a disadvantage immaterial.

Finally, having regard to the circumstances of the Companies and the Liquidator, the Court determined that it was just and equitable to make the pooling orders. The following factors were important:

- there were little to no financial records for the Companies available to the Liquidator;

- the Companies’ funds had been used jointly for at least a decade;

- Kununurra Holdings’ Bank Account satisfied debts owed to both of the Companies’ creditors;

- the ATO, as the major creditor of the Companies, would receive an increased dividend if assets were pooled; and

- by pooling the Companies’ assets, the Liquidator would not be required to determine the extent of any intercompany liabilities; a task that would be burdensome, if not impossible, given the lack of financial records.

Comment

Where two or more companies operate as a corporate group but fail to properly document their relationship, it may be all but impossible for a liquidator to piece the puzzle together and ascertain intercompany loans or liabilities. Where those companies also structure their business so as to share income and/or expenses, or funnel income through one company, creditors may find themselves with little to no prospects of recovery.

Kununurra provides a helpful example of the utility of a pooling order for a liquidator. If a group’s assets are pooled, creditors as a whole may benefit from far greater recoveries. Pooling also relieves liquidators from the need to assess the existence and extent to which the companies may have extended loans to each other, allowing for more efficient group liquidations and, in some cases, significantly reducing liquidators’ fees.

His Honour provided persuasive reasons as to the inapplicability of section 90-15 of the IPSC in seeking pooling orders. Should the matter arise for determination, it is very likely that a court would find that section 90-15 of the IPSC is not as boundless as it is often thought.

Authors

Tags

This publication is introductory in nature. Its content is current at the date of publication. It does not constitute legal advice and should not be relied upon as such. You should always obtain legal advice based on your specific circumstances before taking any action relating to matters covered by this publication. Some information may have been obtained from external sources, and we cannot guarantee the accuracy or currency of any such information.

Key Contacts

Head of Restructuring, Insolvency and Special Situations