Removal of stamp duty on Victorian Commercial and Industrial Property: unpacking the proposed law

28 March 2024

The long-awaited details of Victoria’s stamp duty reform have been released in the form of the Commercial and Industrial Property Tax Reform Bill 2024 (Vic) (CIPT Bill).

The Victorian Government is proposing to remove stamp duty on dealings in relation to commercial and industrial land, and to introduce in its place, a commercial and industrial property tax (CIPT) chargeable annually. This publication highlights some key complexities and implications for real estate investors, financiers and developers.

Key provisions

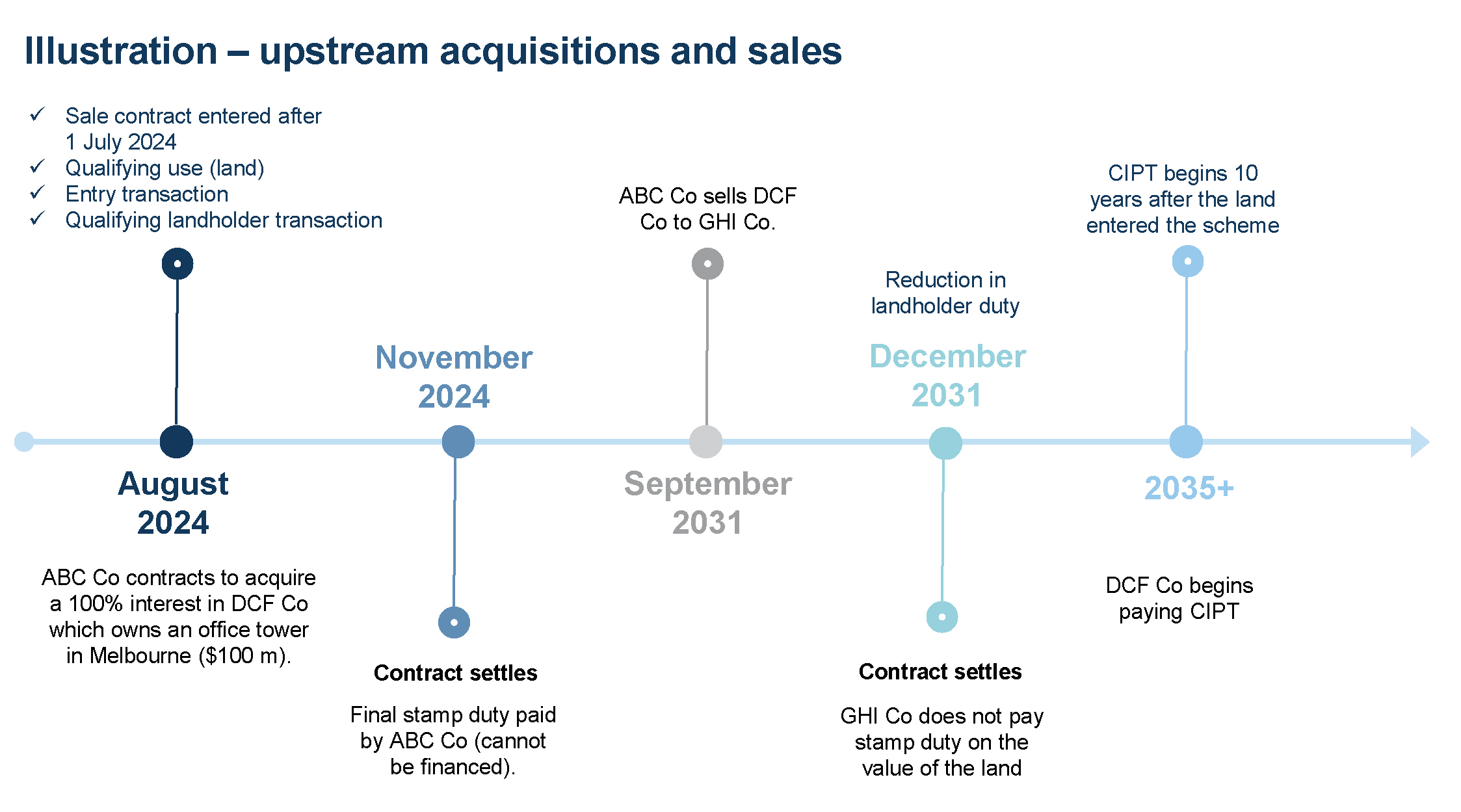

The new scheme is proposed to broadly involve:

- the payment of stamp duty on eligible transactions after 1 July 2024 on one final occasion so long as the land remains subject to a qualifying use;

- the imposition of an annual CIPT at a general rate of 1% on the unimproved value of CIPT taxable land commencing ten years after the eligible transaction described above;

- the provision of an exemption from subsequent stamp duty on a transaction to which the scheme applies;

- a reduction in the calculation of duty on dealings in a landholder that holds scheme land; and

- the availability of a ten-year transition loan from the Victorian Government to eligible borrowers (anticipated to be Australian residents for transactions with a value of up to $30 million) to assist with the funding of the final stamp duty payment.

In short, over time dealings in certain commercial and industrial land will fall outside the current stamp duty regime, and instead the owner of that land will become subject to an annual tax likely to be deductible for income tax purposes as is the case for land tax currently on income producing land.

What land does the scheme apply to?

Under the proposal, commercial and industrial land will enter the scheme if an entry transaction, an entry consolidation or an entry subdivision occurs in relation to the land on or after 1 July 2024.

Contracts executed before 1 July 2024 fall outside the scheme even if they complete after 1 July 2024, and commercial and industrial land that is not the subject of one of the above entry events will remain outside the new regime indefinitely.

What is commercial and industrial land?

Land will only enter the scheme if it has a qualifying use at the date of the relevant entry transaction.

Classification approach

A “qualifying use” depends on how the property is classified under the Australian Valuation Property Classification Code (AVPCC). Under the Valuation of Land Act 1960 (Vic), an annual general valuation for all rateable and non-rateable land as at 1 January in each calendar year must be undertaken – this process includes allocating one or more AVPCC to each property. The general valuation is primarily used for rating, taxing and levying purposes.

Land that is allocated within the 200 – 499, and 600 – 699 ranges (generally, land that is regarded as falling within the commercial, industrial, extractive industries or infrastructure and utilities classifications) will have a qualifying use.

Land that is allocated an AVPCC outside these ranges will not have a qualifying use, unless a special rule applies. Broadly speaking therefore, land that is regarded as residential, primary production, community services, and sports, heritage and culture are not proposed to be part of the scheme.

The one special exception relates to eligible student accommodation (which would otherwise fall under the residential AVPCC but which will be a qualifying use). An eligible student accommodation is a property which is designed for occupation, and is occupied or available for occupation, by students of a higher education provider, if it is regarded as commercial residential premises for GST purposes. Other commercial residential asset classes such as retirement village, aged care, disability housing does not appear to have a qualifying use and would therefore fall outside of the scope of the scheme.

Build-to-rent

The CIPT Bill appears to suggest that the scheme will apply to build-to-rent properties. For example, the Bill proposes a concessional rate of CIPT (of 0.5% as compared to the general rate of 1%) where the land is “BTR land”. However, it is not immediately apparent from the current AVPCC that operational BTR sites would fall within the qualifying AVPCC ranges – an amendment may be required to specifically include BTR land (similar to eligible student accommodation) if such properties are intended to be within the new regime.

Mixed use

Land that is allocated more than one AVPCC (one or more of which are outside the qualifying use range) will be classed as having a qualifying use if the property is ‘solely or primarily’ used for the relevant commercial or industrial AVPCC. This is likely to be relevant to mixed used properties.

How do you enter the tax reform scheme?

Land will enter the scheme if an entry transaction, an entry consolidation or an entry subdivision occurs in relation to the land on or after 1 July 2024.

Entry transaction

An entry transaction will occur where:

- the land is the subject of a qualifying dutiable transaction or a qualifying landholder transaction;

- the land has a qualifying use on the date of the transaction; and

- the transaction relates to an interest in land that is at least 50%, or which amounts to an interest of at least 50% under the aggregation rules.

A qualifying dutiable transaction will include a transfer of land or a declaration of trust over the land, but it will not include a dutiable lease transaction or acquisition of an economic entitlement.

A qualifying landholder transaction is, broadly speaking, a transaction under which a relevant acquisition is made. A person makes a relevant acquisition when the person (alone or with associated persons) acquires a significant interest in a landholder, or acquires a further interest after already holding a significant interest. The significant interest threshold is 50% where the landholder is a private company or wholesale unit trust, and 20% for a private unit trust. This means that a person could make a dutiable relevant acquisition of a 20% interest in a private unit trust that holds qualifying land, without the land entering the scheme as the 50% minimum transacted interest in relation to the land is not satisfied.

A transaction that is eligible for an exemption from duty (for example, change in trustee and transfer to a charity), or for a corporate consolidation or reconstruction concession, will not be a qualifying dutiable transaction or a qualifying landholder transaction.

The date of entry into the scheme, which is relevant for determining when the transition period ends, will generally be the date when completion of the entry transaction occurs.

Consolidation and subdivision transactions

Land can also enter the scheme by a consolidation transaction or a subdivision transaction.

A consolidation or subdivision will not, of itself, cause the land to enter into the scheme. Rather, where there is a consolidation or subdivision, it can incorporate additional parcels of land into the scheme where the majority of the land being dealt with is already within the scheme.

Land that is consolidated on or after 1 July 2024 will be scheme land if at least 50% of the consolidated area comprises land that had entered the scheme. The consolidated land is treated as having entered the scheme on the earliest date on which land that forms part of the consolidation entered the scheme.

However, land that has entered the scheme will cease to be scheme land if it is consolidated with land that has not entered the scheme, and as a result of the consolidation, less than 50% of the area of the consolidated land is scheme land.

These principles also apply where two or more parcels of land are consolidated as part of a subdivision.

Separately, a subdivision of scheme land will be an entry subdivision and the child lots created from the parent lot will also be treated as scheme land. The child lots will be treated as having entered the scheme on the date on which the parent lot entered the scheme.

What happens when land enters the scheme?

Once a property has entered the scheme (and therefore has become scheme land):

- An exemption from stamp duty will apply to a subsequent dutiable transaction in relation to the land, provided that the land has a qualifying use at the time of the transaction and:

- the transaction occurs at least three years after the land entered the scheme; or

- after a final stamp duty has been paid in respect of the interest that is the subject of the transaction; and

- the transaction occurs at least three years after the land entered the scheme; or

- A reduction in landholder duty will apply to a relevant acquisition in an entity that holds scheme land by excluding the value of such land from the calculation of the dutiable value, provided that the land has a qualifying use at the time of the transaction.

CIPT will become payable on scheme land on the expiry of ten years after its entry into the new regime. The cost of CIPT may be a deductible expense for income tax purposes.

CIPT will not be charged on land that is exempt from land tax. This may include for example, land that is used and occupied by a charitable institution, land that is used as a registered caravan park, and land that is used as a mine.

Change in use of tax reform scheme land

Where a change in use event occurs in relation to scheme land or part of the land (ie it moves from a qualifying use to a non-qualifying use, or vice versa), the owner of the land is obliged to notify the Commissioner within 30 days of the change in use event.

In the event that scheme land ceases to have a qualifying use, a liability for duty will crystallise which will in effect operate to clawback the stamp duty exemption or reduction provided by virtue of the property’s previous qualifying use profile. This liability is proposed to be determined based on the duty that would have been payable if the land did not have a qualifying use, with a 10% reduction for each calendar year that has passed since the date of the original transaction. For example, a change in use five years after scheme land is transferred should mean that the duty effectively payable in respect of the transfer is 50% of the duty that would otherwise have been payable if the land did not have a qualifying use at the time of the transfer.

In a landholder duty context, the notification obligations of a person (an upstream acquirer) who made a relevant acquisition of an entity that directly or indirectly held scheme land that subsequently undergoes a change in use are unclear. The Commissioner should have sufficient information to make an assessment of the change in use duty payable by the upstream acquirer based on the combined information from the change in use notification made by the owner of the land and the acquisition statement originally lodged by the upstream acquirer. Perhaps, an upstream acquirer will not have a positive obligation to notify. If this is the intended operation, it should provide upstream acquirers with comfort that they will not inadvertently fail to pay the change in use duty, particularly where they are not involved in day-to-day operations of the landowner.

What are the implications for acquisition contracts?

Contracts for the sale and purchase of land

The CIPT Bill proposes to impose disclosure requirements on vendors, including that the vendor’s statement must state whether or not the land is scheme land (including its entry date) and the AVPCC most recently allocated to the land. As indicated above, this may require judgments to be made in relation to mixed use land.

Property clearance certificates issued by the Commissioner will state whether the land is a scheme land, when it became a scheme land, and when the property became, or will become, subject to CIPT. It will also include information on any CIPT (including interest or penalty tax) due and unpaid.

At present, some but not all land information certificates include information about the AVPCC allocated to a property. It is unclear whether amendments will be made to the regulations made under the Local Government Act 2020 to require the inclusion of AVPCC details in a land information certificate.

As with land tax, it will be an offence for a vendor to enter into a contract of sale for a sale price less than the threshold amount (as at the date of this article, $10 million) to the extent that it purports to require the purchaser to pay an amount towards CIPT that the vendor is, or may become, liable for in respect of the land. Such a provision will be of no effect.

Agreement for leases

Lessors will be prohibited from passing on CIPT to residential and retail tenants.

However, there does not appear to be any such prohibition in relation to other tenants, meaning that subject to the terms of the lease, a lessor should be able to pass on CIPT to commercial or industrial tenants (for example, of an office or warehouse).

What is the transition loan program?

The Victorian Government is proposing to provide a ten-year transition loan program to eligible participants who choose to take up this loan. The CIPT Bill does not include details of the program, but empowers the Treasurer to publish a transition loan notice detailing eligibility criteria and relevant terms and conditions.

The Treasurer has not yet released a transition loan notice.

Based on an information sheet published by the Government however, the loans are likely to have the following features: repayments on an annual basis over a ten year period, an interest rate equal to the Treasury Corporation of Victoria’s bond rate plus a credit risk margin, break fee payable on an early repayment, and the loan must be repaid on a sale of the land or change to non-qualifying use.

It is anticipated that eligible participants will be Australian residents who are the first purchaser on or after 1 July 2024 of a commercial or industrial property for up to $30 million.

The transition loan amount owing will be a statutory first charge on the land. Discussions about this charge will therefore be required with financiers who may otherwise have provided funding for the stamp duty amount in addition to the purchase price as part of the overall facility.

Final thoughts

The new scheme is slated to commence on 1 July 2024, just three months away. While its concept, at a high-level, is simple, there is likely to be considerable difficulty and uncertainty in its practical application. At first blush, the proposed law appears complex and its application is likely to become increasingly more complex where, for example, land (or its owner) is transacted over time, particularly where fractional interests are involved, and as land becomes subject to changes in use.

The earliest that the Bill will be next considered in Parliament is its next sitting date on 30 April 2024. Watch this space.

Authors

Head of Tax

Partner

Partner

Head of Real Estate (Acting)

Senior Associate

Lawyer

Law Graduate

Tags

This publication is introductory in nature. Its content is current at the date of publication. It does not constitute legal advice and should not be relied upon as such. You should always obtain legal advice based on your specific circumstances before taking any action relating to matters covered by this publication. Some information may have been obtained from external sources, and we cannot guarantee the accuracy or currency of any such information.

Key Contact

Other Contacts

Head of Real Estate (Acting)