Preparing for a world without LIBOR: key considerations for loan market participants

02 October 2019

It has been two years since the Financial Conduct Authority (UK) (FCA) announced that the London Interbank Offered Rate (LIBOR) will cease in 2021.

As this deadline nears, and the FCA continues to stress the assumption that there will be no LIBOR publication after end-2021, regulators and industry bodies around the world are urging market participants to prepare for the transition with increasing intensity.

FCA’s Chief Executive, Andrew Bailey, recently commented that firms delaying transition are making a mistake. The CEO of the Asia Pacific Loan Market Association (APLMA) has also stressed that “time is now of the essence” and that members need to be informed of the upcoming “seismic changes”.

In Australia, the Australian Securities and Investments Commission (ASIC) has written to major financial institutions imploring them to undertake a comprehensive risk assessment in respect of their exposure to LIBOR.

What will replace LIBORs?

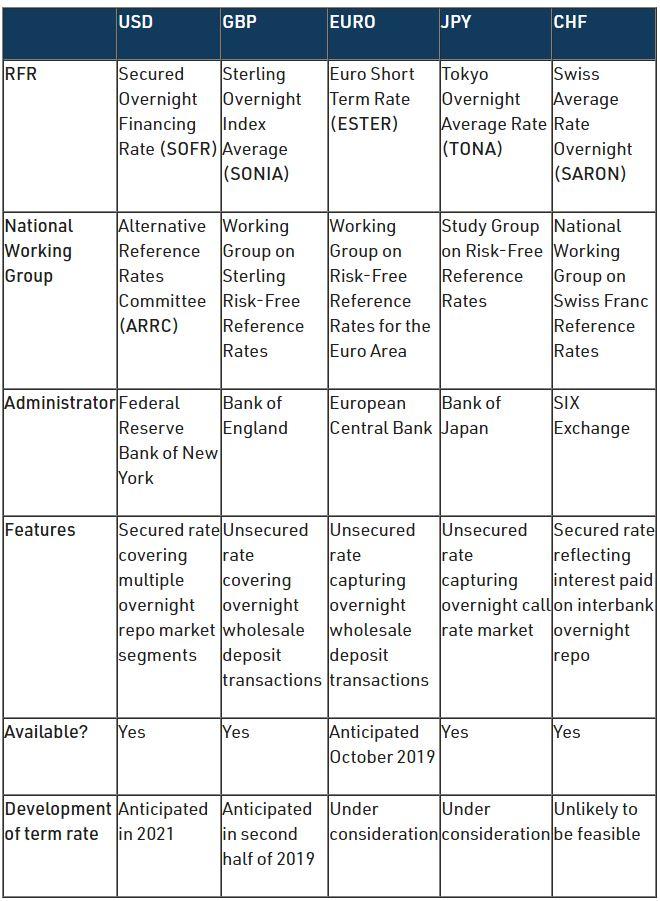

Working groups in different jurisdictions have now each identified an overnight risk-free rate (RFR) for their currency.

Each RFR is at different stage of development, as highlighted in the table below. Unlike LIBOR, the RFR is only an overnight rate, which is available in various term lengths. The RFR, anchored in active and liquid market transactions, is inherently risk-free and so lower than LIBOR (which accommodates credit and term risks).

How can loan market participants prepare for the transition to RFRs?

Due to the difficulty in reconciling the differences between RFRs and LIBOR, the loan market lags behind other financial markets in its transition to RFRs.

As RFR is only an overnight rate, interest amounts are determined at the end of any given interest period. This is troubling for both lenders and borrowers for cash flow management purposes.

There is a push for development of forward-looking term interest rates based on the RFR, using derivative transactions that reference RFR, provided that there is sufficient liquidity. SONIA is the most advanced in developing the Term Sonia Reference Rate.

There is substantial uncertainty regarding the viability and timeline for RFR term rates. Transition is not just about new business, but also about converting legacy LIBOR contracts. Regulators are stressing that RFR term rates will not be the primary avenue for transition, and are urging market participants to proceed with their transition plans to RFR without waiting for RFR term rates to become available.

What else do loan market participants need to consider?

- Existing loan documents. Although many documents include a fallback mechanism if LIBOR is not available, this fallback was designed with temporary unavailability in mind, not a permanent cessation, meaning existing loan documents are not equipped to deal with the transition.

- LMA proposed amendments. In Europe, the Loan Market Association (LMA) updated its Recommended Revised Form of Replacement Screen Rate Clause and User Guide in May last year, expanding the application of the ‘Replacement of Screen Rate’ clause to broader circumstances, including the benchmark administrator announcing that it will cease to provide the benchmark interest rate. The update also introduced a concept of ‘Replacement Benchmark’ to which the parties will transition.

- ARRC proposed provisions for new documents. In the USA, the ARRC has published two sets of contractual provisions called the ‘amendment’ approach and the ‘hardwired’ approach to prepare for a transition to SOFR. The ‘amendment’ approach does not prescribe a successor rate but offers a process for the parties to agree a replacement benchmark. In contrast, the ‘hardwired’ approach prescribes the replacement options to apply in a waterfall fashion. The adoption of the LMA or ARRC proposed clauses are not automatic and must be voluntarily entered into by the parties. For existing loan documents, amendments are required.

Next steps

Loan documents often do not exist in isolation, and simultaneously with amending the rate applicable to the loan, any hedging transaction must also be amended or alternatively terminated (which may trigger break costs) and fresh hedges entered into.

As LIBOR is used in a broad range of commercial (i.e. non-financial) contracts, those contracts must be amended.

Market participants are well advised to consider referencing RFRs for new contracts, identify any contracts that include LIBOR clauses, evaluate their position and prepare for negotiating amendments to documents. For complex cross-border transactions, negotiations may be more protracted than expected, and the clock is ticking.

Authors

Partner

Partner

Tags

This publication is introductory in nature. Its content is current at the date of publication. It does not constitute legal advice and should not be relied upon as such. You should always obtain legal advice based on your specific circumstances before taking any action relating to matters covered by this publication. Some information may have been obtained from external sources, and we cannot guarantee the accuracy or currency of any such information.